The 20-Second Trick For Estate Planning Attorney

The 20-Second Trick For Estate Planning Attorney

Blog Article

Some Known Incorrect Statements About Estate Planning Attorney

Table of ContentsIndicators on Estate Planning Attorney You Need To KnowThe Single Strategy To Use For Estate Planning AttorneyA Biased View of Estate Planning AttorneyEstate Planning Attorney for Dummies

Your attorney will also assist you make your papers authorities, scheduling witnesses and notary public trademarks as essential, so you do not need to bother with trying to do that final action on your very own - Estate Planning Attorney. Last, yet not the very least, there is valuable peace of mind in developing a relationship with an estate preparation lawyer that can be there for you down the roadwayBasically, estate planning attorneys give worth in lots of ways, far past simply offering you with published wills, trust funds, or various other estate planning documents. If you have inquiries regarding the process and wish to find out more, call our workplace today.

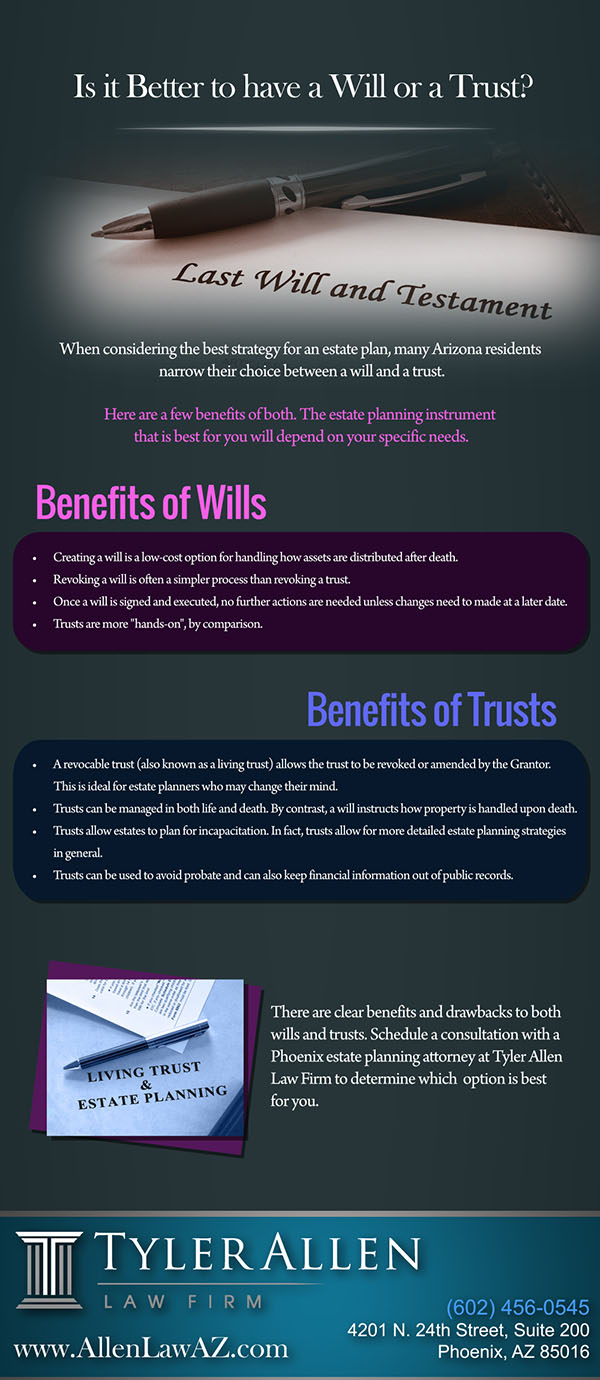

An estate preparation lawyer aids you define end-of-life choices and lawful records. They can establish wills, establish trust funds, produce healthcare regulations, establish power of lawyer, create sequence plans, and extra, according to your desires. Working with an estate preparation attorney to complete and oversee this lawful paperwork can assist you in the following 8 locations: Estate preparing lawyers are professionals in your state's trust, probate, and tax regulations.

If you don't have a will, the state can determine how to split your properties amongst your heirs, which might not be according to your desires. An estate preparation attorney can help arrange all your lawful records and distribute your possessions as you desire, possibly avoiding probate.

The Basic Principles Of Estate Planning Attorney

As soon as a customer dies, an estate strategy would certainly determine the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions might be entrusted to the following of kin or the state. Duties of estate planners consist of: Developing a last will and testimony Establishing depend on accounts Calling an executor and power of attorneys Identifying all beneficiaries Calling a guardian for small youngsters Paying all financial debts and lessening all taxes and legal fees Crafting guidelines for passing your worths Developing preferences for funeral arrangements Wrapping up guidelines for treatment if you end up being ill and are incapable to make choices Acquiring life insurance coverage, impairment income insurance policy, and long-lasting care insurance policy An excellent estate plan should be upgraded consistently as customers' financial scenarios, individual motivations, and government and state legislations all evolve

Similar to any type of career, there are attributes and skills that can aid you accomplish these goals as you function with Get the facts your clients in an estate organizer duty. An estate planning career can be appropriate for you if you possess the complying with traits: Being an estate organizer means assuming in the lengthy term.

Rumored Buzz on Estate Planning Attorney

You need to assist your customer anticipate his or her end of life and what will occur postmortem, while at the exact same time not home on dark thoughts or emotions. Some clients may come to be bitter or distraught when contemplating death and it can be up to you to aid them via it.

In the occasion of fatality, you may be expected to have numerous discussions and dealings read here with enduring household participants regarding the estate plan. In order to excel as an estate organizer, you might need to walk a great line of being a shoulder to lean on and the specific trusted to interact estate planning matters in a prompt and expert way.

tax obligation code changed countless times in the 10 years in between 2001 and 2012. Expect that it has actually been altered additionally because after that. Depending on your customer's financial earnings brace, which may advance toward end-of-life, you as an estate organizer will have to maintain your client's possessions in complete legal compliance with any kind of local, government, or international tax regulations.

Some Known Questions About Estate Planning Attorney.

Getting this accreditation from organizations like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Being a member of these professional teams can confirm your abilities, making you a lot more appealing in the eyes of a prospective client. Along with the psychological incentive helpful clients with end-of-life planning, estate planners enjoy the advantages of a steady earnings.

Estate planning is a smart thing to do no matter of your current health and financial status. The very first important point is to employ an estate preparation attorney to aid you with it.

An experienced attorney recognizes what information to include in the will, including your recipients and special considerations. It additionally provides the swiftest and most efficient approach to transfer your assets to your recipients.

Report this page